This article talks about how to download student invoices generated for your academy.

Let's begin by understanding how to update your GST information first.

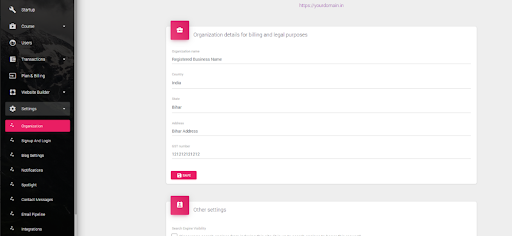

Setting up GST information for Invoices

To ensure timely GST invoice generation, subscribers must add/edit their organization's GST details by following the steps below :

- Log in and access 'Settings' in the dashboard

- Click on the first option i.e. “Organization”

- Please fill in all organization details, including the GST number, and click "Save" to complete the setup.

GST-based invoices for learners depend on their location. For more information, visit: How to enable GST-based Invoices for students?

Student Invoices: Access and Download

Note: Knorish has no control over course pricing. All prices listed on your Knorish-built site include GST and applicable taxes. No GST invoices are issued for free courses.

Student invoices can be downloaded from the dashboard under Earning in Transactions.

To download invoices and sales data, follow these steps:

- Access the site's dashboard

- Click on Earning under Transactions

- Use Data Filters to select options like Date Range, Currency, Course, Coupon, and Transaction Type.

- Choose the number of entries needed per page

- Download Excel sheets with student names, order IDs, and amounts paid.

- Individual invoices can also be downloaded as needed.

Note: Facing an Internal Server Error when downloading student invoices from the publisher dashboard?

This often happens if the "Invoice to student download" template has incorrect code or variables. Resetting the template should resolve the issue and allow you to download invoices again.

Ensure GST details are added for invoices. Each format includes 100 entries. Download additional entries by selecting page numbers.

Filing GST: Additionally, for GST filing, you can download and submit the datasheet in CSV, Excel, and PDF formats. If needed, individual invoices can also be downloaded one at a time.

How students can download their invoices directly :

- Log into your student account.

- Click the "Profile Icon" and select "Invoice".

- Choose the invoice you want to download.

We will generate a PDF file and send it directly to the device the user is using.

Important Considerations:

You can also click on ADD GST to setup GST based invoices for your students which are issued automatically when they purchase a new course. To learn more about that, read: Enable GST-based Invoices for students from your site.