GST is an Indirect Tax in India levied on the domestic supply of goods & services. Hence, if you are selling online courses, you can provide GST based invoices to your learners. However, note that all prices listed on your site are considered to be inclusive of all taxes. Hence, please price your courses accordingly. Once the setup is complete from the total price listed on your platform, the tax breakup is listed on the course.

This article describes how to set up GST details on your site to enable learners to download GST compliant Invoices.

Applicable Scenarios for GST

Basis the location of the supplier and the receiver, there are 5 primary scenarios wherein the GST based invoices will change information.

- Publisher and student are from the same location and both from India.

- Publisher Location is India and state is Haryana and Student is also from India and Haryana then CGST and SGST will be applied in the Invoice.

- Publisher and student are from India but different states.

- Publisher and student both are from India but the publisher is from Haryana and the student is from Maharashtra then IGST will be applied.

- Publisher is from India but the student is from Outside India.

- The publisher is from India and the student location is outside India then no tax will be applied on the invoice.

- Publisher is outside India then no GST invoice can be generated.

- No tax will be applied. Vat will be built later. Currently, even B2B don't have VAT.

- Publisher is from India and Haryana and the student has not selected any location at the time of checkout.

- The publisher is from Haryana, India and the student has not selected any location, then based on the student' IP address, we will get the location. If the location is detected as India then CGST and IGST will be listed and if the location is not detected as India then no tax will be applied on the invoice. As per the GST rule, if a buyer as not defined his location, it is considered to be in the same state as the seller.

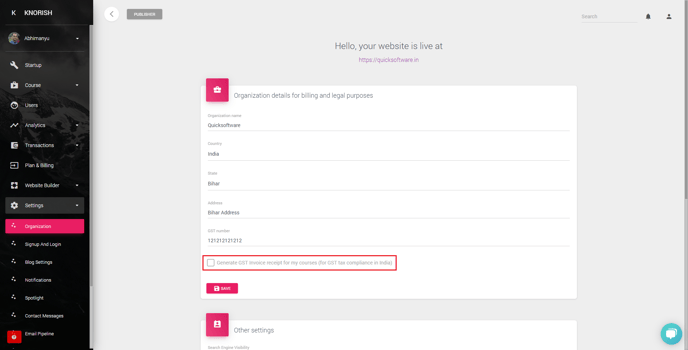

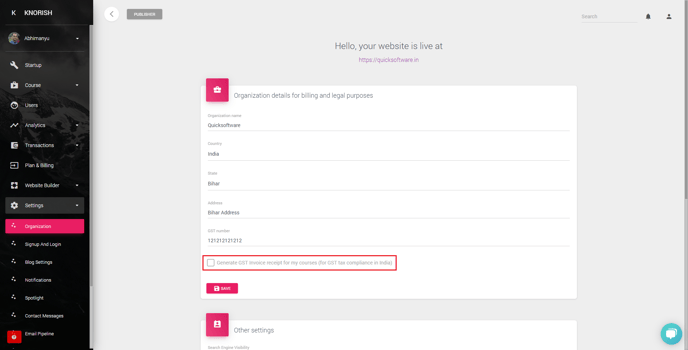

Adding Your GST information for Invoices

To ensure the timely generation of the GST Invoices, subscribers must ensure that the requisite details have been listed on the platform. Please follow the steps listed below to add or edit your organizations GST details:

- Login to your Knorish account and access 'Settings' in the dashboard,

- Click on the first option i.e. “Organization”

- Complete the details about the organization including the GST number information. Once done, click on save to complete the setup.

Once saved, the information listed here will be used to issue invoices such as

- Knorish subscription and renewal invoices,

- Invoices issued to your learners.

If you wish to allow your learners to claim GST, please follow the steps listed below.

Setup Invoices to enable GST Input Credit Claim by learners

- Select ‘Generate GST Invoice receipt for my courses’

- Click on ‘Save’ to save the details.

Once this is done, the platform will automatically generate the invoices with the information listed in this section.

Important Note: Do ensure to check the Invoice template available under Templates. As marked in the image below, the code should be listed there. In case the GST section does not have the dynamic code listed there, please add the code so that the information is added automatically and invoice is generated properly.

Students view

Once enabled, learner’s will see another option just above the payment screen. The learners who wish to claim input tax can choose this option and complete their details and the invoice will be issued accordingly.

Note: All invoices are generated automatically. Once issued, they cannot be changed or modified.

These invoices can be downloaded by students from the orders section available in their account. Shown below is how the invoice would appear to a student.